What Are Alternative Investments?

Investments are a means to increasing wealth. We often indulge in traditional investments such as fixed deposits, stocks, and shares. But, there is another form of wealth multiplication method, widely known as Alternate Investment Fund (AIF).

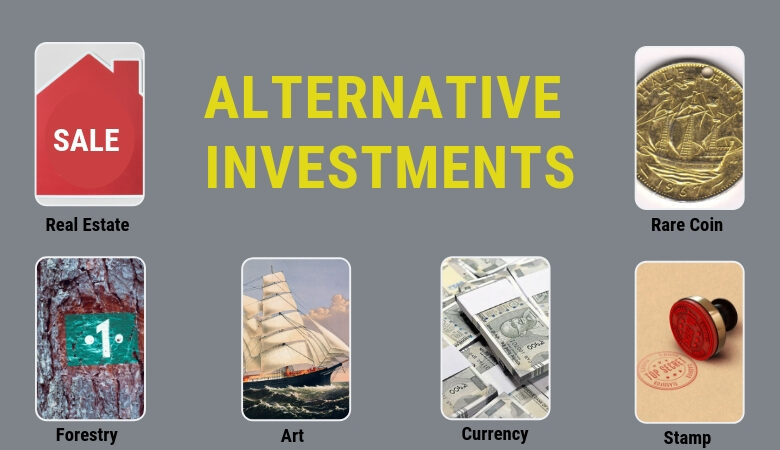

Alternative investments provide an avenue for individuals to park their funds into non-traditional asset classes or strategies, which have the ability to return profits irrespective of the performance of capital markets. The term ‘alternative’ is often used to refer to tangible assets such as real estate, commodities, hedge funds, venture capital, private equity, and art.

An Alternate investment fund is a privately pooled investment vehicle that collects funds from investors for investing in accordance with a defined policy in India. There are three categories in AIF – Category I, II, and III, each with its own investment strategy and restrictions. The category I and II AIFs are generally close-ended and have a minimum tenure of 3 years, while Category III AIFs can be open-ended.

Investors often search for MFs with highest return to ensure high yield on their investments. However, these returns are influenced by market volatilities and are not always guaranteed. While an AIF may embody higher risks, they can potentially yield higher returns when professionally managed.

Considering financial planning from the Indian perspective, if you want to invest, say ₹5,00,000 in an AIF and the expected annual return is around 12%, after a period of 5 years, the investment could grow to approximately ₹8,80,000. This is nearly twice the initial investment. It is important to note here that these figures are based on hypothetical rates of return and actual returns may vary.

See also: Mutual fund Calculator

However, every investor should be cautious that investing in alternate investment funds might not be suitable for everyone. The risks associated with these investments are different and potentially more complex than those associated with traditional investments. It’s also crucial for investors or potential investors to know their own risk tolerance.

Disclaimer: This article provides an overview of alternative investments in the Indian financial market. It doesn’t recommend anyone to invest in these forms. Investing in the financial market, be it traditional or alternative, comes with its own advantages and risks. Therefore, potential investors should carefully evaluate all the factors before making any investment decision. This information must not be interpreted as financial advice. Market risks are involved, read all scheme-related documents carefully. The actual results may vary based on market conditions.